Just as the mighty Amazon River winds through the South American rainforest, so too does the e-commerce giant Amazon.com flow through the world of business. With its stock listed on NASDAQ under the ticker symbol AMZN, this tech behemoth has become a household name and a dominant force in online retail. From humble beginnings selling books out of a garage to now offering everything from groceries to electronics, Amazon’s exponential growth and innovation have captivated investors and consumers alike. Let’s dive into the wild waters of Amazon.com • Stock • NASDAQ:AMZN to explore what makes this company an unstoppable force in today’s market.

Key Stats For Amazon.com Stock On NASDAQ:AMZN

Looking at the key stats for Amazon.com stock on NASDAQ: AMZN, it is crucial to understand how this information can impact your investment decisions. With Amazon.com being a major player in the e-commerce industry, tracking its stock performance on NASDAQ: AMZN is essential. The stock price of Amazon.com reflects not only the company’s financial health but also market sentiments and trends. By analyzing key statistics such as earnings per share, revenue growth, and market capitalization, investors can gain valuable insights into the potential risks and rewards of investing in Amazon.com stock.

Moreover, understanding the volatility of Amazon.com stock on NASDAQ: AMZN can help investors make informed decisions about when to buy or sell. Keeping an eye on factors like trading volume and historical price movements can provide valuable context for interpreting current stock data. Additionally, monitoring key ratios like P/E ratio and dividend yield can give insight into the valuation and profitability of Amazon.com stock compared to industry peers.

As you evaluate these key stats for Amazon.com stock on NASDAQ: AMZN, remember that thorough research and analysis are essential for making sound investment choices. Stay informed about market developments and continuously assess the relevance of new information to your investment strategy. Now let’s delve into some important facts to know about Amazon.com today – from recent acquisitions to emerging competition in the e-commerce landscape.

Important Facts To Know About Amazon.com Today

When looking at important facts to know about Amazon.com today, it’s crucial to consider the company’s strong presence in the e-commerce market. With a vast product selection and convenient delivery options, Amazon has solidified itself as a go-to destination for online shopping. Additionally, Amazon’s Prime membership program continues to attract millions of subscribers worldwide, providing exclusive benefits such as free two-day shipping and access to streaming services like Prime Video.

Moreover, Amazon’s expansion into other industries beyond just e-commerce is worth noting. The company’s cloud computing division, Amazon Web Services (AWS), has become a major player in the tech industry, offering services to businesses around the globe. Furthermore, Amazon Studios has made a name for itself in the entertainment industry by producing award-winning original content. These diversifications have contributed to Amazon’s overall success and growth over the years.

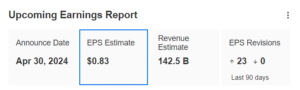

As we look ahead to what’s next for Amazon.com, one key aspect to keep an eye on is the upcoming earnings report. This financial update will provide valuable insights into the company’s performance and future outlook, impacting stock prices and investor sentiment.

Upcoming Earnings Report For Amazon.com

As we eagerly await the upcoming earnings report for amazon.com, one can’t help but wonder what kind of financial fireworks will be showcased. Will their profits soar to new heights, or will they plummet like a failed drone delivery? The suspense is palpable, with investors anxiously holding their breath as they anticipate the big reveal.

In the world of e-commerce juggernauts, anticipation is key when it comes to deciphering the success or failure of a company’s quarterly performance. With so much at stake and billions on the line, every penny counts in determining whether Amazon will continue its reign as king of online retail or face some unexpected turbulence ahead. So grab your popcorn and get ready for the show – it’s about to get real interesting.

Transitioning now into the next section about key statistics for amazon.com’s performance…

Key Statistics For Amazon.com Performance

Let’s take a closer look at some key statistics that shed light on amazon.com’s performance. Despite facing challenges, the company has managed to maintain steady growth in various aspects of its operations. One notable statistic is the stock price, which has shown resilience and stability amidst market fluctuations. Additionally, nasdaq:amzn continues to be a strong performer, attracting investors’ attention with its promising prospects for future growth.

As we delve deeper into amazon.com’s performance metrics, it becomes evident that the company’s strategic initiatives have yielded positive results. From revenue generation to customer acquisition, each statistic reflects amazon.com’s commitment to excellence in all facets of its business operations. The upcoming earnings report is eagerly anticipated by analysts and stakeholders alike, as it will provide further insights into the company’s financial health and overall trajectory.

Turning our focus towards the latest news updates on amazon.com, let’s explore how recent developments are shaping the company’s outlook moving forward.

Latest News Updates On Amazon.com

Amazon.com’s stock performance on the NASDAQ (AMZN) has been making headlines lately, with a fascinating statistic indicating a significant increase in their revenue for the last quarter. The latest news updates reveal that Amazon continues to dominate the e-commerce market and expand into new territories, solidifying its position as a powerhouse in the retail industry. Investors are keeping a close eye on any developments coming from this tech giant.

As we delve deeper into the technical analysis and stock broker recommendations for Amazon.com, it is crucial to consider how these recent news updates may impact future trading decisions.

Technical Analysis And Stock Broker Recommendations For Amazon.com

While you might think that predicting the future of a giant like Amazon.com would be easy, the truth is far from it. Technical analysis and stock broker recommendations for nasdaq:amzn can vary widely, leaving investors scratching their heads in confusion. However, by diving into the numbers and trends, experts attempt to provide some clarity on what lies ahead for this e-commerce behemoth. From potential buy signals to cautionary sell indicators, there’s no shortage of opinions when it comes to navigating the complex world of stock trading.

As we sift through the plethora of information available on amazon.com’s stock performance, one thing becomes clear – uncertainty reigns supreme. Despite all the metrics and analyses at our disposal, the market remains unpredictable and volatile. While some may swear by technical indicators as their guiding light, others rely on gut instincts or insider tips to make their investment decisions. The bottom line is that when it comes to stocks like nasdaq:amzn, anything can happen – making each move a calculated risk worth taking in the ever-changing landscape of the stock market.

Conclusion

Amazon.com’s stock on NASDAQ: AMZN continues to show strong performance and growth potential. With upcoming earnings reports, it is crucial for investors to stay informed about key statistics and the latest news updates. Based on technical analysis and broker recommendations, now may be a good time to consider investing in this tech giant before it becomes an “old school” investment choice.

FAQs

What is the highest Amazon stock price?

The all-time high Amazon stock closing price was 189.50 on May 09, 2024. The Amazon 52-week high stock price is 191.70, which is 3.3% above the current share price. The Amazon 52-week low stock price is 118.35, which is 36.2% below the current share price. The average Amazon stock price for the last 52 weeks is 155.10.

What is the name of Amazon Nasdaq?

AMAZON COM INC (AMZN)

Who is no. 1 in the share market?

RELIANCE INDUSTRIES LTD. TATA CONSULTANCY SERVICES LTD. ICICI BANK LTD. BHARTI AIRTEL LTD.